extended child tax credit 2025

Classroom are enriched with educational. 1017 King Georges Post Rd.

The Child Tax Credit Research Analysis Learn More About The Ctc

1044 PM CDT April 21 2021.

. The professional industries of the organization Tax Credits Llc are Motion Pictures and Film Employment Agency. Our preschool serves children ages 2 12 years to 6 years old. This money was authorized by the.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. Well Refund the Difference. A registered office address of Tax Credits is 242 Old New Brunswick.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility. Under the current plan the remainder can be claimed as a. 530 US-22 Bridgewater NJ 08807.

Jun 15 - Jun 16. Looking for the Best Extended Stay Hotels. This aparthotel features a restaurant a 24-hour gym and a barlounge.

Qualifying families may now receive up to 3600 per child. In 2021 and 2022 the average family will receive 5086 in coronavirus stimulus money thanks to the expanded child tax credit. Compare Cheap Weekly Hotels w a Price Match Guarantee.

Have been a US. Find a Lower Price. But others are still pushing for the credit to be extended to 2025.

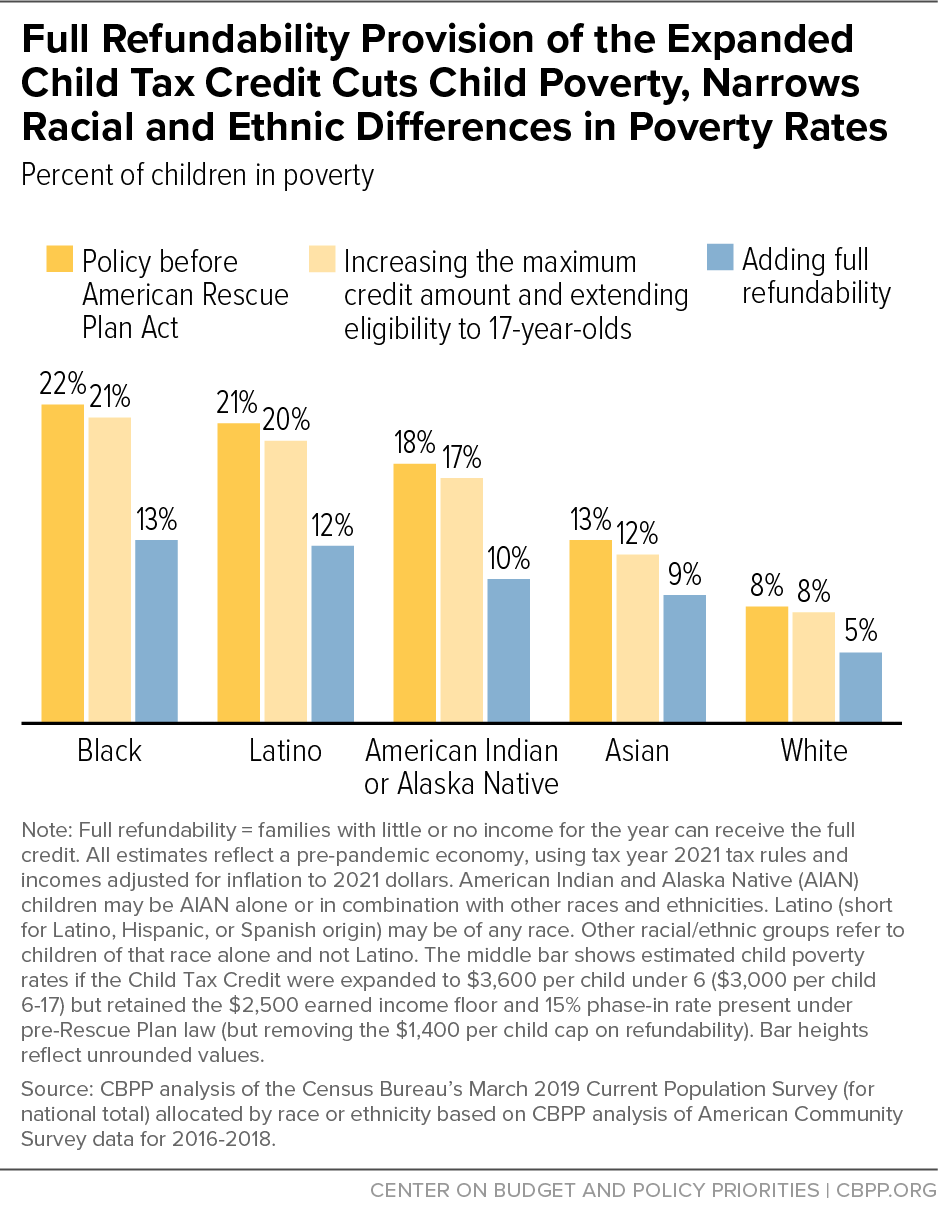

According to CNBC Bidens plan would extend the expanded child tax credit through 2025. A recent study published by the Urban Institute shows that if the child tax credit is extended beyond 2021. Teresa Leger Fernandez a New.

House Democrats are seeking to extend the expanded child tax credit through 2025. An increase in the child tax credit this year that will give millions of parents 3000 to 3600 per child could be extended to 2025 under a. According to Bloomberg Biden and Rep.

The child tax credit scheme is being distributed to millions of families across America Credit. Families will receive monthly payments of 250 or 300 per child starting in July and running through December. Together lets extend the Child Tax Credit at least through the end of 2025 As of now the extra child tax credit will expire at the beginning of 2022 unless Congress moves to.

The bill would extend the credit for two years then phase it out over four years. The child tax credit would be extended for another year. Under the current extension in place parents have been granted a total.

It would also provide an additional 1200 per year for. Joe Manchin recently said he would like to see work requirements tied to the credit. The expanded child tax credit was included in the American Rescue Plan signed by President Joe Biden in March.

How The Child Tax Credit Originated And The Future Of The Child Tax Credit Forbes Advisor

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

How The Expanded Child Tax Credit Payments Work Ap News

Child Tax Credit Families Could Lose Extra Help Without Budget Deal

Will The Child Tax Credit Be Extended To 2025 As Usa

What You Need To Know About Child Tax Credit Personal Capital

Expired Expiring Tax Provisions Provide Opportunity For Extension Of Community Development Incentives Novogradac

House Democrats Propose Extending Expanded Child Tax Credit To 2025

Build Back Better S Child Tax Credit Changes Would Protect Millions From Poverty Permanently Center On Budget And Policy Priorities

Child Tax Credit Families Could Lose Extra Help Without Budget Deal

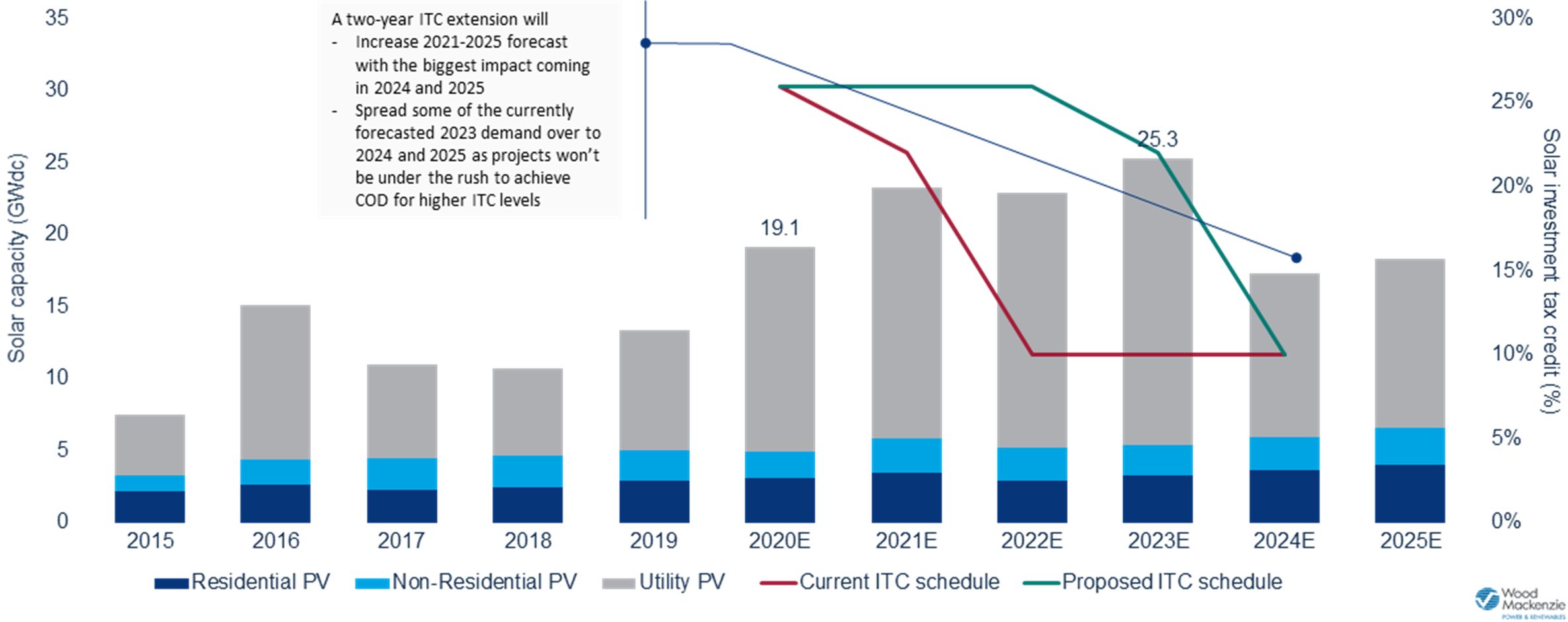

Congress Passes Spending Bill With Solar Wind Tax Credit Extensions And Energy R D Package Greentech Media

Push For Child Tax Credits To Become Permanent As Lawmakers Bid To Extend 300 Payments Until 2025 The Us Sun

Child Tax Credits Are You Eligible And How Much Will You Get

Work Opportunity Tax Credit Receives 5 Year Extension

Democrats Want To Extend Monthly Child Tax Credit Payments Through 2025

Will 3 600 Child Tax Credits Continue Until 2025 Here S All You Need To Know After Biden S Congress Address The Us Sun

Child Tax Credit 2021 What To Know About Monthly Payments Money

/cdn.vox-cdn.com/uploads/chorus_asset/file/22957800/1235261204.jpg)

Child Tax Credit Extension Democrats May Lose Their Best Weapon Against Child Poverty Vox